So, you’re thinking about crowdfunding for business? It’s a funding model that's taken off and offers a variety of benefits if you're looking to fund your venture. Businesses raise money through crowdfunding now more than ever, so let's explore how you can succeed with your fundraising goal.

What is Crowdfunding for Business?

Crowdfunding involves gathering small amounts of money from many people to fund a business venture.

This differs from traditional business loans, where businesses seek large sums from banks or a few investors. Crowdfunding for business is more like a community-sourced investment.

Harness the power of the masses to bring your business vision to life with donation-based, reward-based, equity or debt crowdfunding campaigns.

Types of Crowdfunding for Businesses

Not all crowdfunding is the same. There are several types, each suited to different business needs and stages of a business plan.

1. Reward-Based Crowdfunding

This is the most recognizable type. Backers on platforms like Kickstarter and Indiegogo receive a reward in exchange for their contribution.

Rewards are typically early access, discounted pricing, or exclusive merchandise.

Rewards-based is ideal for product launches or creative projects and is a popular choice for small business owners.

Kickstarter

Kickstarter campaigns are all-or-nothing.

You receive the funds only if you reach your fundraising goal within the campaign deadline. It's important you set the right target goal for your campaign and reach it, otherwise you'll receive zero funds.

Kickstarter has hosted over 592,000 projects, and their fee structure includes a 5% platform fee plus 3-5% transaction fees if the campaign succeeds.

Indiegogo

Indiegogo gives flexible options for businesses.

They can opt for fixed (like Kickstarter) or flexible funding where they keep the funds collected regardless of whether the goal is reached.

Indiegogo fees amount to a 5% platform fee on all funds raised, with an added transaction fee of 3% plus $0.20.

2. Equity Crowdfunding

Equity-based crowdfunding offers backers company shares in return for their investments through equity funding.

Platforms such as StartEngine, Fundable, and Crowdcube are hubs for equity crowdfunding.

This model is best suited for growth-focused companies seeking more than just funds, like larger investments and long-term investor relationships.

Fundable's fee structure includes a $179 monthly subscription with no success fees, meaning whatever money you collect is yours.

Crowdcube charges a 7% fee on successful investments plus a 0.75%—1.25% completion fee. Payment processing fees, depending on the debit and credit card, can be up to 2.9%.

StartEngine charges issuers between 5% and 12% of the total amount raised, focusing on Reg CF (Regulation Crowdfunding) and Reg A+ offerings.

These are two crucial exemptions to securities regulations in the US, each governed by distinct rules.

By understanding the Regulation Crowdfunding (Reg CF), small businesses unlock the potential to reach larger fundraising goals, potentially $75 million annually under Reg CF.

3. Debt Crowdfunding

This works like a traditional loan. Backers essentially act as lenders, loaning you the funds, and you repay them with interest over time.

This can provide capital quicker than traditional business loans or securing venture capital, but consider the cost of interest payments and associated platform fees. Look into platforms like Funding Circle for debt crowdfunding.

4. Donation-Based Crowdfunding

Platforms like GoFundMe and Mightycause focus on charitable projects or causes.

Backers donate out of support without any expectation of financial returns or rewards.

Mightycause caters particularly to nonprofits and social good initiatives, and reports over $600 million raised on its fundraising platform.

Their fee structure is subscription-based ($79 to $119/month, plus as little as 0.9% + $0.29 for payment processing.

GoFundMe is a massive donation-based platform that facilitates fundraising campaigns for personal causes and aids nonprofits with donation processing.

According to recent reports, a staggering $30 billion has been raised through the platform.

Choosing the Right Platform

Picking a crowdfunding platform can be challenging, as many factors are involved, such as the type of crowdfunding campaign you want to launch.

Your project, business type, financial goals, and desired level of investor involvement all factor into this decision. Kickstarter might be your platform for creative projects offering physical or digital products.

Consider StartEngine, Fundable, or Crowdcube among the best crowdfunding sites for equity-based crowdfunding, and GoFundMe among the best crowdfunding sites for donation-based crowdfunding. Be sure to check out other sites if neither of these suits your needs.

Shopify businesses seeking pre-orders for funding could use the Crowdfunder app. Nonprofits would find Mightycause or GoFundMe more fitting.

CrowdStreet offers opportunities to connect with accredited investors for a niche market like real estate. They specialize in vetting high-quality, large-scale commercial real estate investment opportunities in the US.

Crowdfunding for Business: Building a Successful Campaign

Launching a campaign is only half the battle. What do you mean? You might be asking.

Dear reader, a successful crowdfunding campaign also requires good marketing, clear messaging, and an engaging story to raise funds.

Let's cover the essentials of successful crowdfunding. A solid business plan underpins crowdfunding campaign success.

Effective Crowdfunding

Storytelling and messaging are important. You want to clearly tell your brand or product's story and explain the funding's purpose with a clear breakdown of how the funding will be used.

Creating an emotional connection is vital. You want to emotionally connect with investors with a passionate and excited tone, showing enthusiasm for your business to attract supporters.

I recommend you check out this Kickstarter article on 8 storytelling tips to help enhance your crowdfunding campaign.

Crafting a good story is worth it. I can tell you directly from experience.

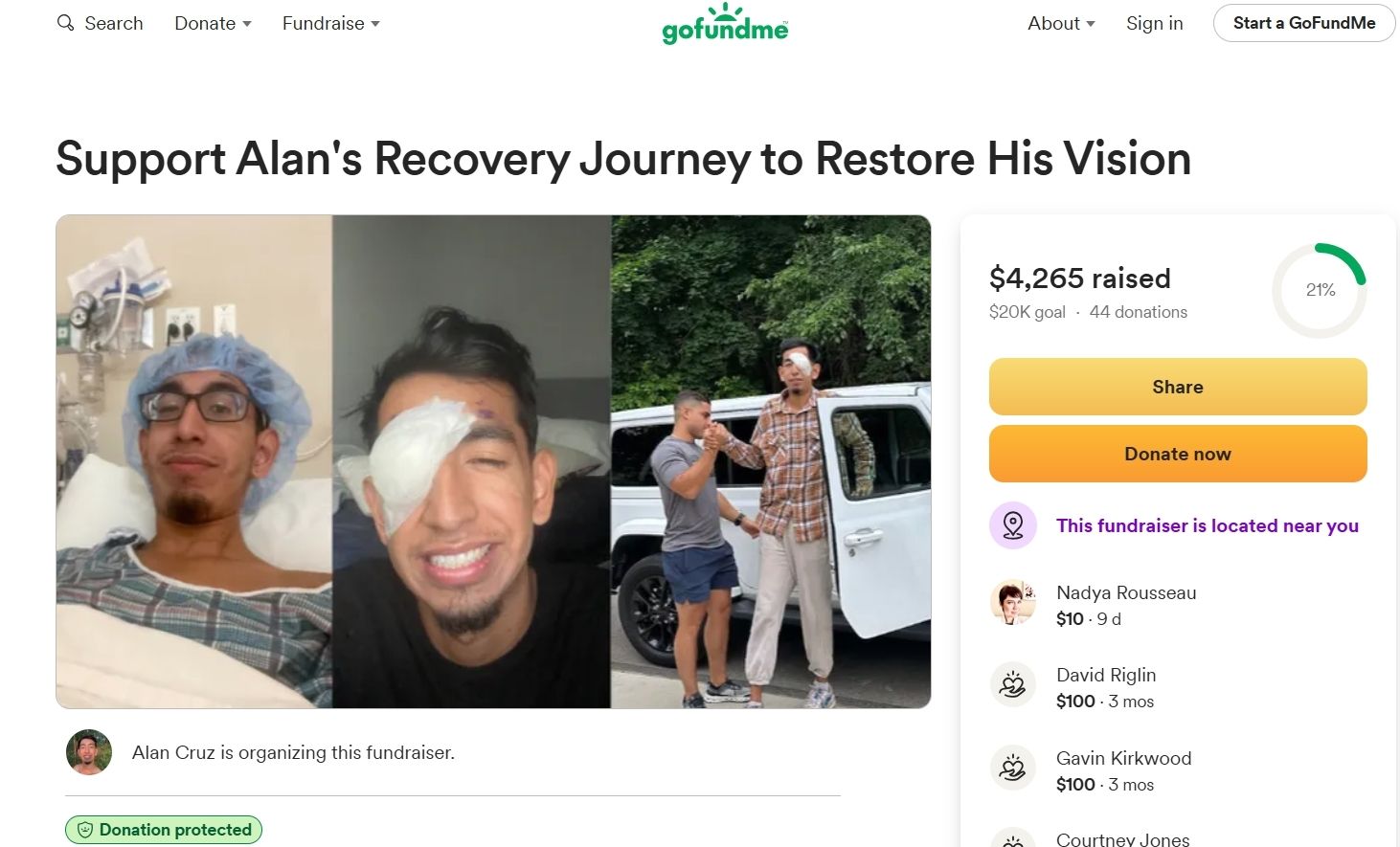

In August 2024, I created a GoFundMe campaign to raise money for my eye surgery recovery. Though not business-related, by utilizing storytelling concepts and creating an emotional connection with donors, I raised over $4,000+ in less than two weeks to support myself while I recovered and was out of work. This taught me never to doubt the power of storytelling and emotional connections because it can make a difference in raising funds for your business (and your life).

Compelling Visuals and Videos

Use strong visuals to grab attention and engage viewers, creating a greater emotional connection than just plain old text.

This can look like:

- Showing prototype images.

- Sharing your production process via video.

- Showing a behind-the-scenes of you and your team.

- Highlighting the impact your product or service makes in the world.

Community Building

Crowdfunding thrives on community support. Actively connect and engage with your backers and build a community on social media.

Provide regular updates and respond to comments. You want to make your supporters feel invested by providing inside information (hence mentioning behind-the-scenes content of you and your team; make them feel part of the process).

Remember to express your gratitude for all sizes of donations and ensure supporters feel valued.

Realistic Goals and Timeline

Set attainable funding goals based on costs for project completion. Have a timeline that considers unforeseen challenges and don't be afraid to modify your campaign plan if there's any changes in your original crowdfunding plan.

Start Crowdfunding for Your Business

Crowdfunding for business can be powerful if approached strategically.

Different methods cater to various needs, and the market shows substantial capital circulation via crowdfunding platforms.

Selecting the right platform is just as crucial as crafting a compelling campaign that resonates with backers.

Consider this path an alternate funding model or a way of testing the demand for your idea and generating pre-orders. Remember, there are people out there willing to support you. It's up to you to put your idea, product, and service out there, and see what magic unfolds.

FAQs

Can you crowdfund for a business?

Absolutely. As mentioned in this article, crowdfunding for business is a great way to launch your business idea, product, or service. Crowdfunding campaigns are a low-risk and easy way to get started and raise money for a small business if pulled off right.

You can check out crowdfunding sites like Indiegogo, Kickstarter, GoFundMe, and Fundable.

What are the four types of crowdfunding?

The four types of crowdfunding are:

- Reward-based crowdfunding: Receive a reward in exchange for a contribution (Indiegogo, Kickstarter).

- Equity-based crowdfunding: Receive company shares and equity in exchange for investments (Fundable, StartEngine).

- Debt-based crowdfunding: Backers act as lenders, loaning you funds, and you repay them with interest over time (Funding Circle).

- Donation-based crowdfunding: Supporters donate out of support without any expectation of financial returns or rewards. (GoFundMe, Might Cause).

Check out different crowdfunding sites depending on your small business and company goals. Each crowdfunding platform operates differently, so it's important to do your research.

Does Crowdfunding need to be paid back?

No, crowdfunding does not need to be paid back in most cases.

Crowdfunding primarily operates through receiving donations for your small business and venture that do not need to be paid back, especially if it's donation-based or reward-based crowdfunding. Equity-based crowdfunding allows investors to receive a small piece of equity in the company in exchange for contributions.

However, there are exceptions. These exceptions can include debt-based crowdfunding, where supporters loan you money, and you repay them back with interest over time.

Be sure to research crowdfunding sites and crowdfunding platforms for specific rules and regulations. Every platform is different.

Is crowdfunding good for small businesses?

Absolutely, especially for small businesses that lack capital or startup funds in the beginning. Compared to traditional business loans and credit cards,

crowdfunding for business operates through donation-based contributions that do not need to be paid back, helping small businesses build capital without incurring traditional debt.

Research and find the best crowdfunding platform for your small business and venture goals.

Check out our other articles!