Latino small business grants are vital for many Latino and Hispanic entrepreneurs starting or expanding businesses. These grants offer a path to a brighter future, where anyone can thrive.

Thanks to Latino small business grants, I've seen businesses that were once just ideas in someone's head become successful realities. Regardless of your level of experience, one thing is certain: securing a small business grant can be a key to elevating your Latino-owned small business.

In this article, we'll be diving into some Latino small business grants for small businesses.

The Growing Impact of Latino-Owned Businesses

Latino entrepreneurs play a significant role in our economy. According to research from the Stanford Latino Entrepreneurship Initiative (SLEI), our businesses are responsible for roughly 50% of net new small business growth over the past decade.

According to the SBA, there are now approximately 400,000 to 450,000 Hispanic-owned businesses in the U.S. And in 2021 alone, Latino-owned businesses generated over $500 billion in revenue.

Despite the value our community brings to the economy and workforce, a significant number of Latino and Hispanic entrepreneurs continue to struggle to secure the necessary capital they need.

Enter Latino Small Business Grants

Latino small business grants are funding opportunities designed to assist Latino and Hispanic businesses. Unlike business loans, grants do not require repayment. Expanding a business without breaking the bank is every business owner's dream, and grants help bring that dream within reach.

From local and national government agencies to private companies and passionate non-profits, the funding behind these grants is as diverse as the initiatives they support.

Aside from funding, Latino small business grants can also provide mentorship, networking opportunities, and access to a community of business owners and industry leaders.

Top Grant Opportunities for Latino Entrepreneurs

Here are some promising grant programs for Latino small business owners.

For this article, we define 'Latino small business grants' as grants that:

- Are specifically for Latino and Hispanic entrepreneurs and business owners.

- Latino and Hispanic business owners can apply for.

Check out our finance and funding page, which has resources on additional grants, loans, and accelerator programs to elevate your business today!

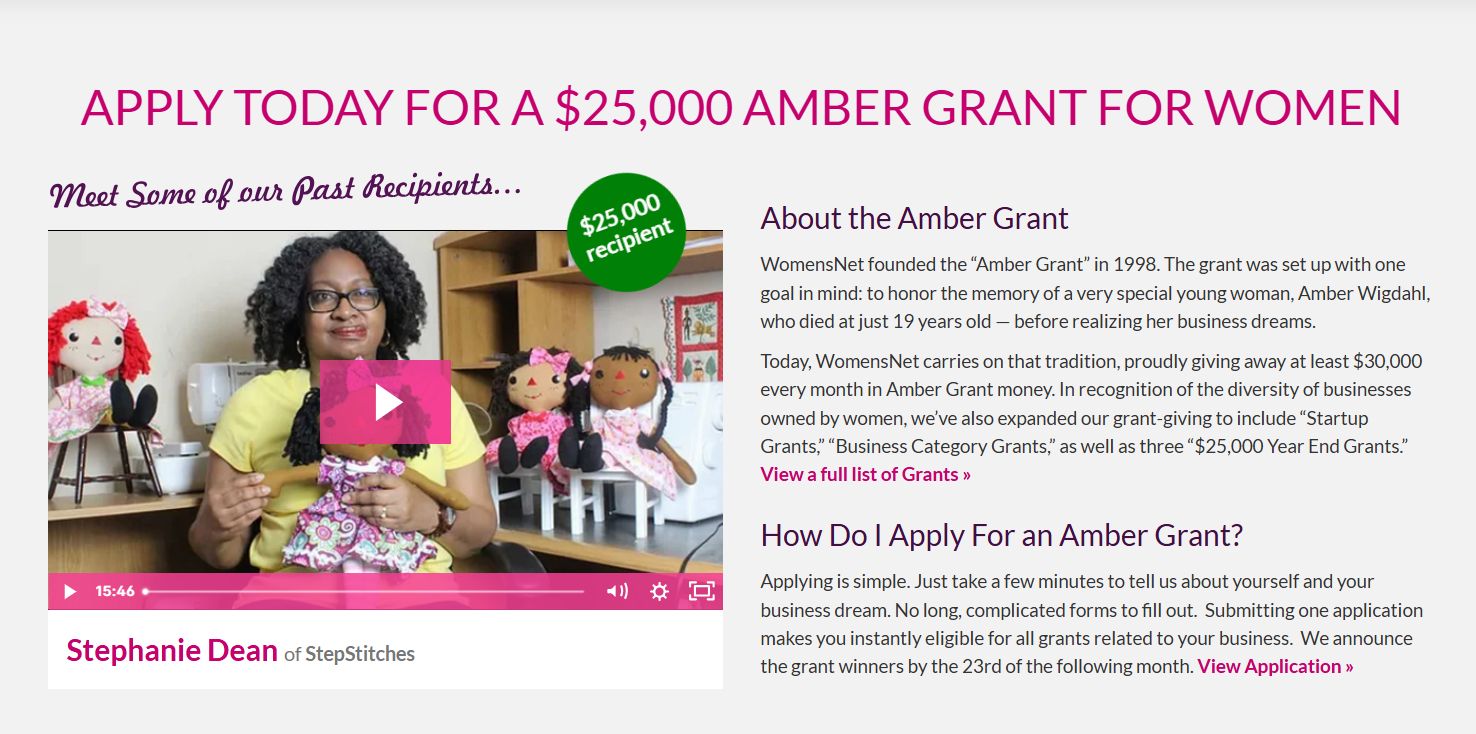

1. The Amber Grant

Calling all Latina business owners and entrepreneurs, the Amber Grant awaits you. Though not exclusively for Latinas, the Amber Grant awards women-owned businesses $10,000 monthly and $25,000 annually.

In October 2024, the owner of Moy Studio, Mónika Reyes Maldonado, was awarded the $10,000 monthly Amber Grant. Based in Puerto Rico and founded in 2018 after the devastating Hurricane Maria, Moy Studio is a sewing school that teaches people the art of creating clothing, offering in-person workshops, private classes, and online courses.

2. NASE Growth Grants

The National Association for the Self-Employed (NASE) offers growth grants up to $4,000 to its members. This grant is not limited only to Latino business owners, but it offers Latino entrepreneurs the chance to grow and scale their small businesses.

3. The Antares REACH Grant

In partner with Hello Allice and the Global Entrepreneurs Network, the Antares REACH program is 12-week business accelerator that offers the opportunity to secure up to $20,000 in grant funding.

Eligibility for the accelerator and grant funding includes:

- Generating over $50,000 in revenue with an established product or service.

- Majority owned by individuals from marginalized and diverse backgrounds (income, ethnicity, sexuality, gender identity, etc.)

- Must be in the U.S., District of Columbia, or Puerto Rico.

4. SIA Scotch Entrepreneurial Spirit Fund

Founded by Carin Luna-Ostaseski, a first-generation Latina and Cuban American, the SIA Scotch fund offers $10,000 grants annually to entrepreneurs of color in the food and beverage industry.

Past recipients of this grant fund include Gabriela Cervantes, a first-generation Mexican American and founder of Postres Cafe. A 2016 master's graduate from the University of Southern California's School of Social Work, Gabriela explored her own entrepreneurship path after a year working as a social worker and opened Postres Cafe in 2020.

Resources Beyond Grants

Grants aren’t the only resources for Latino entrepreneurs. Explore specialized financing options like Community Development Financial Institutions, SBA Loans, and others that prioritize small business success.

Community Development Financial Institutions (CDFIs)

Community Development Financial Institutions, or CDFIs, are instrumental in providing funds to underserved communities. They're open to working with entrepreneurs who don't fit the traditional lending mold and are willing to tailor repayment terms to fit each business's unique situation.

CDFIs include banks, credit unions, loan funds, microloan funds, and VCs.

In fact, check out some of the top 10 VC firms supporting Latino entrepreneurs and funding resources for small businesses like yours.

Learn more about CDFI's on the U.S. Department of Treasury's government site and find one in your local community.

Small Business Administration (SBA) Loans

The SBA has several beneficial loan programs for Latino business owners:

- 7(a) Loans: The SBA's most common loan program, offering up to $5 million for various business purposes.

- 504 loans: Long-term, fixed-rate loans to finance major fixed assets, promoting business growth.

- SBA microloans: Smaller loan amounts for those just starting their business or those with limited credit history.

Networking and Support Organizations

Organizations like the United States Hispanic Chamber of Commerce (USHCC) offer networking and resources for over 4.7 million Hispanic-owned businesses in the United States.

The National Association for the Self-Employed (NASE) provides growth grants to business owners who become members, offering real opportunities for growth.

Interested in joining a Latino/Hispanic entrepreneur community and network? Check out our Community & Networks resource page.

Minority-owned businesses, including those founded by Latino and Hispanic entrepreneurs, can turn to the Accion Opportunity Fund for the small business loans they need to grow and thrive.

When it comes to accessing working capital, Camino Financial has a thing or two to offer Latino entrepreneurs. Their resources include small business loans, business credit information, business management strategies, and general resources for entrepreneurs.

Tips for Securing Latino Small Business Grants

Applying for grants can be competitive. So you're driven to succeed, but need a little guidance? Look no further – these indispensable tips will set you on the path to victory.

Research Thoroughly

Use resources like Grants.gov to find opportunities and research specific grant requirements. Do in-depth research to determine whether a grant is right for your business.

Prepare a Solid Business Plan

Demonstrate your business plan, vision, and potential to grant providers. Consider potential business finance expenses you could face and learn how you will account for them.

Seek Professional Help

Consider a grant writer or business advisor to improve your application and find specific information to help you land those grants.

More Resource Opportunities Than Ever

Initiatives like the $70 million Equitable Access Fund by Hello Alice and the Global Entrepreneurship Network show growing support for diverse business owners. Financial support for entrepreneurs from underrepresented groups has long been out of reach – but these organizations and startups are changing that narrative.

At the Latino Economic Development Center, business owners find a trusted partner that equips them with the tools and guidance they need to succeed in a competitive landscape through their loan programs, workshops, and business resources offered in all 50 states and Puerto Rico.

Apply for Latino Small Business Grants Today

In today's world, there are more financial and funding opportunities at our fingertips than ever before. For Latino entrepreneurs, small business grants are vital for growth and economic prosperity, not only for our businesses but also for our communities.

Whether you're just starting out or expanding your Latino-owned business, there are networks of government programs, organizations, and initiatives ready to help. So don't wait—apply for grants like the SIA Scotch Fund, Amber Grant, and Antares REACH Grant today.

Securing a grant is only the first step. Beyond grants, the real work begins: building and scaling a business that will last for generations.

FAQs

Are small business grants hard to get?

Yes, small business grants can be hard to obtain. Small business grants are incredibly competitive because funders only have a limited amount of funding available.

Grants are also considered free funding. Unlike a loan, which must be repaid back, grants do not have to be re-paid back to the funder, making grants an attractive opportunity for hundreds of thousands of small businesses.

Small business grants also have very specific criteria that a business must meet, otherwise they'll be considered ineligible. Strong applications are also beneficial, with the ability to showcase your business need and clear plan on how you'd use the grant funding.

Are there grants for minority businesses?

There are many grants minority businesses and Latino businesses can apply to. Grants for minority businesses come from a variety of sources like private institutions, non-profits, and government agencies.

Some grants for minority businesses include:

- The Amber Grant: Monthly $10,000 grant awarded to women entrepreneurs.

- FedEx Small Business Grant: Annual grant offering up to $50,000 to minority owned businesses in the United States.

- HerRise Microgrant: Monthly grant providing $1,000 for women of color entrepreneurs and under-resourced businesses.

-

What are Latino small business grants I can apply to?

Latino small business grants you can apply to include:

Check out our other articles!